A Deep Dive into the ROI of Integrating Salesken and Generative AI in Insurance

Table of Content

Abstract

- The whitepaper explores the transformative potential of generative AI in the insurance industry, focusing on its applications and implications, with an emphasis on the return on investment (ROI) of integrating generative AI in insurance sales.

- Salesken, a cutting-edge platform, combines generative AI with insurance sales expertise to revolutionize the sales process by offering AI-driven lead prioritization, automated content generation, sentiment analysis, conversation optimization, and smart recommendations.

- A data-driven ROI analysis demonstrates significant improvements in lead qualification, need discovery, and closing rates after implementing Salesken, translating to increased revenue, reduced costs, and enhanced customer experiences for insurance companies.

- The whitepaper highlights the strategic advantage of adopting Salesken to accelerate growth and maximize ROI, emphasizing its role in refining lead management, delivering personalized customer experiences, and optimizing sales conversions for insurance companies in a rapidly evolving industry.

Introduction: The World Meets Generative AI

The rapid evolution of artificial intelligence (AI) in the twenty-first century has brought forth a groundbreaking achievement: generative AI. This subset of AI focuses on creating novel content, such as text, images, audio, and video, by synthesizing data from large datasets. Generative AI gained momentum in the late 2010s, with OpenAI's release of the GPT series of models, and the global AI market is projected to grow at a compound annual growth rate (CAGR) of 40.2% from 2021 to 2028.

This whitepaper will explore the return on investment (ROI) analysis from generative AI, specifically in sales for the Insurance industry, elucidating its transformative impact on the global economy. We will delve into the applications and implications of generative AI, demonstrating how Insurance institutions can leverage these technologies to create value, enhance efficiency, and drive innovation.

Understanding Generative AI: What it is & what it’s not

Generative AI, a powerful subset of machine learning, is revolutionizing various industries with its ability to create novel content, such as text, images, audio, and video. Leveraging advanced techniques like Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), and the GPT series by OpenAI, these models learn from large datasets to generate previously unseen outputs. However, to fully harness the potential of generative AI, it is essential to understand what it is, and what it is not, and debunk any misconceptions that may hinder its effective implementation.

Leveraging Salesken+Generative AI in Insurance Sales

The insurance industry is undergoing a digital transformation, with a growing need to modernize traditional sales processes and enhance customer experiences. Salesken presents a powerful solution for insurance companies to revolutionize their sales approach, harnessing the power of AI to drive efficiency, reduce costs, and increase revenue.

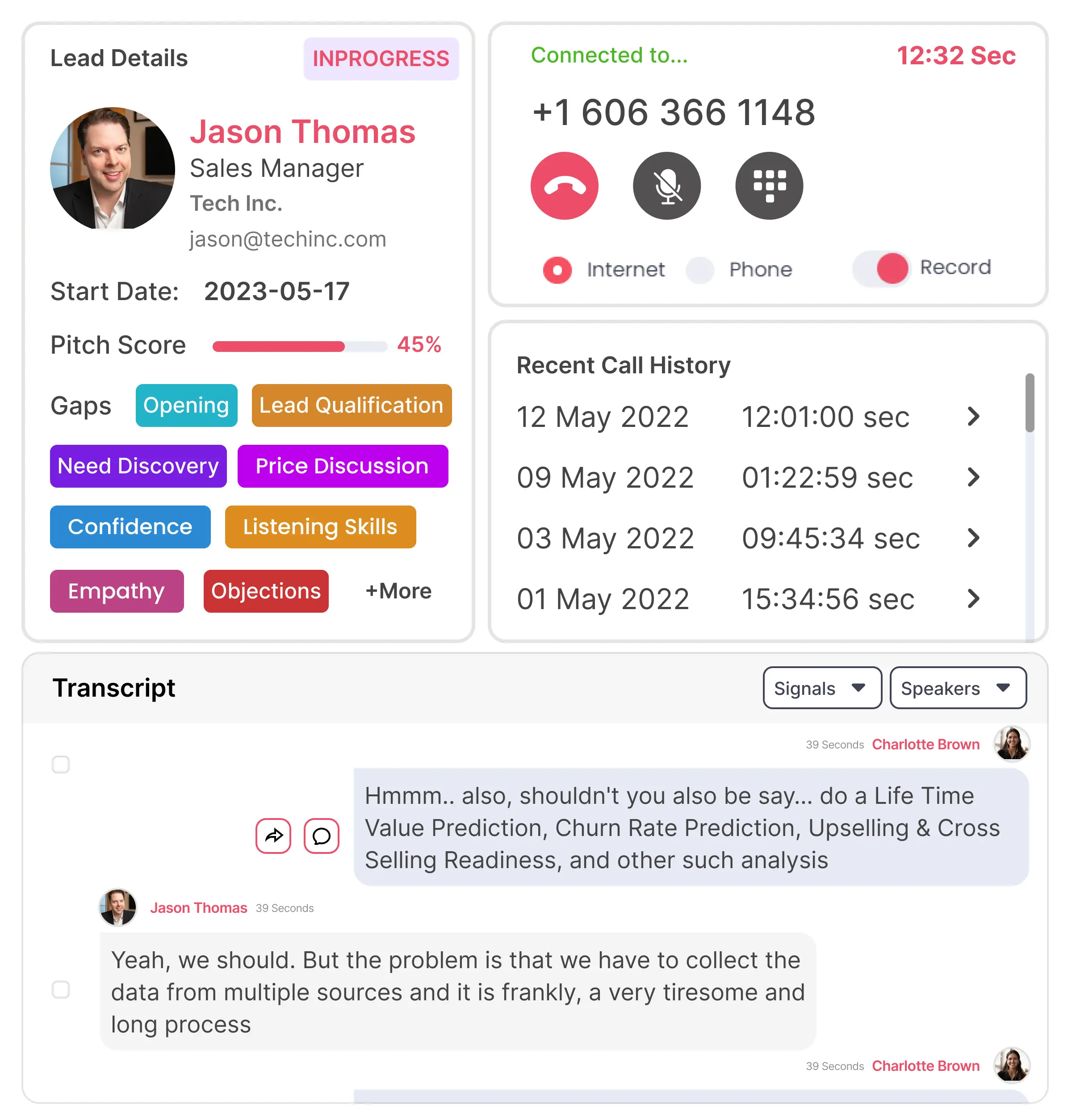

Salesken, a cutting-edge platform, combines generative AI with insurance sales expertise to address the industry's challenges and streamline the sales process. By integrating AI-driven technologies, Salesken empowers insurance sales agents with personalized solutions, automates repetitive tasks, and provides insights to enhance decision-making.

Key features of Salesken include:

Real-time cues:

The real-time cues provide valuable insights for sales reps, enabling them to have more effective conversations with potential clients. Salesken's platform analyzes data in real time and generates personalized cues for sales reps, including conversation suggestions, objection-handling tips, and next steps. This real-time guidance allows sales reps to focus on building relationships and closing deals, without the need to spend excessive time crafting marketing materials. Ultimately, Salesken's real-time cues help sales reps to maximize their productivity and achieve better outcomes.

Smart recommendations:

Salesken's AI-powered recommendation engine suggests the most relevant insurance products and services based on customer profiles, preferences, and needs. These personalized recommendations improve customer satisfaction and increase the likelihood of policy sales.

AI-driven lead prioritization:

Salesken's generative AI algorithms analyze customer data to identify the most promising leads, enabling agents to focus their efforts on high-conversion prospects. This targeted approach increases the likelihood of successful sales and maximizes agent efficiency.

Sentiment analysis and conversation optimization:

Salesken's AI-driven sentiment analysis provides real-time insights into customer emotions and preferences, enabling agents to tailor their sales pitch and approach accordingly. By understanding the customer's needs and pain points, agents can engage in more meaningful, personalized interactions that boost conversion rates.

By harnessing the power of AI, insurance companies can revolutionize their sales approach with Salesken, resulting in increased efficiency, reduced costs, and higher revenue generation. This technological integration ensures a significant return on investment and positions insurance firms for sustained growth in the competitive market landscape.

In the following section, let’s look at the data collected by Salesken by helping Insurance companies in their sales process.

Data-Driven ROI Analysis for Insurance Industry

The insurance industry has always been data-centric, relying on statistical models and risk assessments to determine policy pricing and underwriting. The advent of generative AI in the sales process has opened up new opportunities to harness this data, driving growth and profitability. In this section, we will delve into a data-driven ROI analysis for the insurance industry, examining the impact of implementing Salesken+Generative AI on sales performance.

In order to get detailed insights on the impact Salesken has on the sales teams in an Insurance company, we have gathered some data that showcases the areas where our product has helped institutions.

The dataset provided highlights the improvements in various dimensions of the insurance sales process before and after implementing Salesken:

Data-Driven ROI Analysis for Insurance Industry

The insurance industry has always been data-centric, relying on statistical models and risk assessments to determine policy pricing and underwriting. The advent of generative AI in the sales process has opened up new opportunities to harness this data, driving growth and profitability. In this section, we will delve into a data-driven ROI analysis for the insurance industry, examining the impact of implementing Salesken+Generative AI on sales performance.

In order to get detailed insights on the impact Salesken has on the sales teams in an Insurance company, we have gathered some data that showcases the areas where our product has helped institutions.

The dataset provided highlights the improvements in various dimensions of the insurance sales process before and after implementing Salesken:

Script Intelligence

Selling Best Practices

Average Deal Size Increase:

With generative AI capabilities, Northeast Insurance Company witnesses a 15% increase in their average deal size. Considering their previous average deal size of $10,000, this results in an average deal size increase of $1,500.

Monthly Revenue Increase (Upselling and Cross-Selling)

By leveraging generative AI, Northeast Insurance Company is able to identify upselling and cross-selling opportunities more effectively. This leads to a 15% increase in monthly revenue generated from these strategies. Considering their previous monthly revenue of $100,000, this results in a monthly revenue increase of $15,000.

Monthly Revenue Increase (Shortened Sales Cycle)

Generative AI capabilities enable Northeast Insurance Company to streamline their sales cycle by 20%. This reduction in the sales cycle leads to a monthly revenue increase of $20,000, considering their previous monthly revenue of $100,000.

Monthly Revenue Increase (Lead Conversion)

With generative AI assisting in lead nurturing and management, Northeast Insurance Company observes a 10% increase in lead conversion rates. This translates to a monthly revenue increase of $10,000, based on their previous monthly revenue of $100,000.

Total Monthly Revenue Enhancement

The combined effect of these enhancements amounts to a total monthly revenue enhancement of $46,500 for Northeast Insurance Company. Generative AI's implementation and the utilization have proven to be instrumental in driving these improvements. It's important to note that these numbers may vary depending on the specific circumstances and effectiveness of the AI implementation.

$46500

Improvement across the sales process

By analyzing the data, it's evident that implementing Salesken & Generative AI in the insurance sales process results in significant improvements across various dimensions. This improved sales performance translates to tangible benefits for insurance companies, including

A data-driven ROI analysis for the insurance industry highlights the transformative impact of integrating Salesken into the sales process. By harnessing the power of AI, insurance companies can achieve higher efficiency, reduced costs, and increased revenue generation. This strategic investment in generative AI not only delivers a significant return on investment but also positions insurance firms for sustained growth in an increasingly competitive market landscape.

Automation of Routine Tasks

Generative AI automates repetitive and time-consuming tasks, freeing up sales reps to focus on more complex and value-added activities. This automation leads to a 30% reduction in operational costs. In this case, the cost reduction would amount to $100,000 x 30% = $30,000 per month.

$30,000 per month

Improved Forecast Accuracy

With generative AI's forecasting capabilities, the bank achieves better accuracy in predicting market trends and customer behavior. This allows for improved resource allocation and prevents unnecessary costs associated with poor decision-making. Let's assume the bank previously incurred $150,000 per month in costs due to ineffective resource allocation. With generative AI, they achieve a 25% reduction in these costs, resulting in a cost reduction of $150,000 x 25% = $37,500 per month.

$37,500 per month

Resource Allocation Optimization

Generative AI optimizes resource allocation by directing the salesforce's efforts towards the most profitable opportunities. This leads to a 20% reduction in costs related to inefficient resource utilization. Assuming the bank's previous costs were $200,000 per month, the cost reduction would be $200,000 x 20% = $40,000 per month.

$40,000 per month

Training Time and Cost Reduction

Generative AI-driven training modules significantly reduce the time and cost associated with sales training for the NBFC bank. Let's assume the bank previously spent $50,000 per month on training. With generative AI, they achieve a 30% reduction in training costs, resulting in a cost reduction of $50,000 x 30% = $15,000 per month.

$40,000 per month

Total Monthly Cost Reduction

The combined effect of these cost reductions amounts to a total monthly cost reduction of $30,000 + $37,500 + $40,000 + $15,000 = $122,500 for the NBFC bank.

$122,500

In conclusion, the NBFC bank achieves a monthly cost reduction of $122,500 by leveraging generative AI in their sales processes. These numbers can vary based on the specific circumstances and effectiveness of the AI implementation. However, they illustrate the potential cost-saving benefits of generative AI in sales operations for an NBFC bank.

Real-time call transcription and compliance monitoring:

Salesken can transcribe all the calls in real time, allowing insurance sales reps to ensure that they do not make any mistakes and follow all the necessary compliance regulations during customer interactions. The real-time transcription feature helps supervisors and managers to monitor sales calls for adherence to privacy policies, providing opportunities for immediate feedback and corrective actions.

GDPR compliance and ISO 9001 certification:

Salesken's AI tool is fully compliant with GDPR and CCPA regulations and holds the ISO 9001 and SOC2 certifications, ensuring that the platform adheres to the highest standards of quality management and data privacy. By choosing Salesken, insurance companies can have confidence that their sales assistance solutions are in line with global data protection standards.

Consent management:

Salesken's platform is designed to ask customers for their permission before recording their calls, in compliance with privacy regulations that require informed consent for data collection and processing. This feature demonstrates respect for customers' privacy rights and helps insurance companies maintain transparency in their data-handling practices.

Ensure regulatory compliance:

Salesken's platform is designed to help insurance companies comply with various data privacy regulations, such as GDPR, CCPA, and HIPAA. The platform enables organizations to obtain and manage customer consent, provide transparent information about data usage, and implement necessary safeguards.

Protect sensitive data:

Salesken's advanced security measures, such as encryption and access controls, help protect sensitive customer data from unauthorized access and breaches.

Offer personalized services without compromising privacy:

Salesken uses AI algorithms that leverage anonymized and aggregated data to provide personalized services without revealing identifiable information.

Foster ethical AI practices:

Salesken is committed to responsible AI development and usage, ensuring that its algorithms are transparent, unbiased, and respect individuals' privacy rights.

By incorporating these features and adhering to privacy regulations, Salesken provides a comprehensive solution for insurance sales representatives to maintain compliance with data privacy policies while enhancing their sales processes and customer interactions.

Accelerating growth & ROI with Salesken:

Salesken's AI-driven methodology can significantly enhance the sales process for insurance companies, resulting in higher efficiency, cost reduction, and revenue generation. The integration of Salesken provides a significant return on investment, positioning insurance firms for continued growth in a highly competitive market.

Here are some specific ways in which Salesken can fuel growth and maximize ROI for insurance companies:

In addition to the previously mentioned benefits, Salesken can significantly reduce preventable losses for insurance companies. According to the data provided, integrating Salesken into the sales process can decrease preventable losses by up to 200%. This means that insurance companies can expect to recover substantial revenue that would have otherwise been lost due to preventable errors.

Salesken + Preventable Losses

These figures demonstrate the significant financial impact of preventable losses on an insurance company's bottom line. By implementing Salesken, insurance companies can significantly reduce these losses and increase their sales revenue by up to 200%.

By bringing Salesken on board, insurance companies can significantly enhance their sales process, leading to greater efficiency, cost reduction, and higher revenue generation. This technological integration not only offers a significant return on investment but also positions insurance firms for continued growth in a highly competitive market.

In summary, implementing Salesken in the insurance sales process presents a strategic advantage for companies aiming to propel growth and maximize their ROI. By refining lead management, delivering personalized customer experiences, and optimizing sales conversions, Salesken enables insurance companies to excel in a rapidly evolving industry, as supported by the provided data.

Use Cases & ROI Impact of Salesken

The transformative potential of Salesken extends beyond the insurance industry, offering a range of use cases and significant ROI impact across various sectors, including Insurance, Logistics, SaaS, Medical Devices, and Medical equipment. In this section, we will explore how Salesken's generative AI capabilities can drive growth, enhance customer experiences, and maximize ROI for businesses operating in these industries.

In addition to the previously mentioned benefits, Salesken can significantly reduce preventable losses for insurance companies. According to the data provided, integrating Salesken into the sales process can decrease preventable losses by up to 200%. This means that insurance companies can expect to recover substantial revenue that would have otherwise been lost due to preventable errors.

Conclusion

Salesken is a transformative solution for insurance companies seeking to boost their topline revenue. By harnessing the power of generative AI and integrating it into the sales process, Salesken enables insurance sales agents to optimize lead management, deliver personalized customer experiences, and enhance sales conversions. With its AI-driven real-time cues, smart recommendations, lead prioritization, and sentiment analysis capabilities, Salesken empowers sales teams to maximize their productivity and achieve better outcomes. The data-driven ROI analysis showcases the significant improvements across various dimensions of the sales process, highlighting the potential for increased revenue, reduced costs, and enhanced customer experiences. Implementing Salesken positions insurance firms for sustained growth in today's competitive market landscape.

.png)

.png)

.png)

.png)

.png)